Knowledge Base

Bank Statements

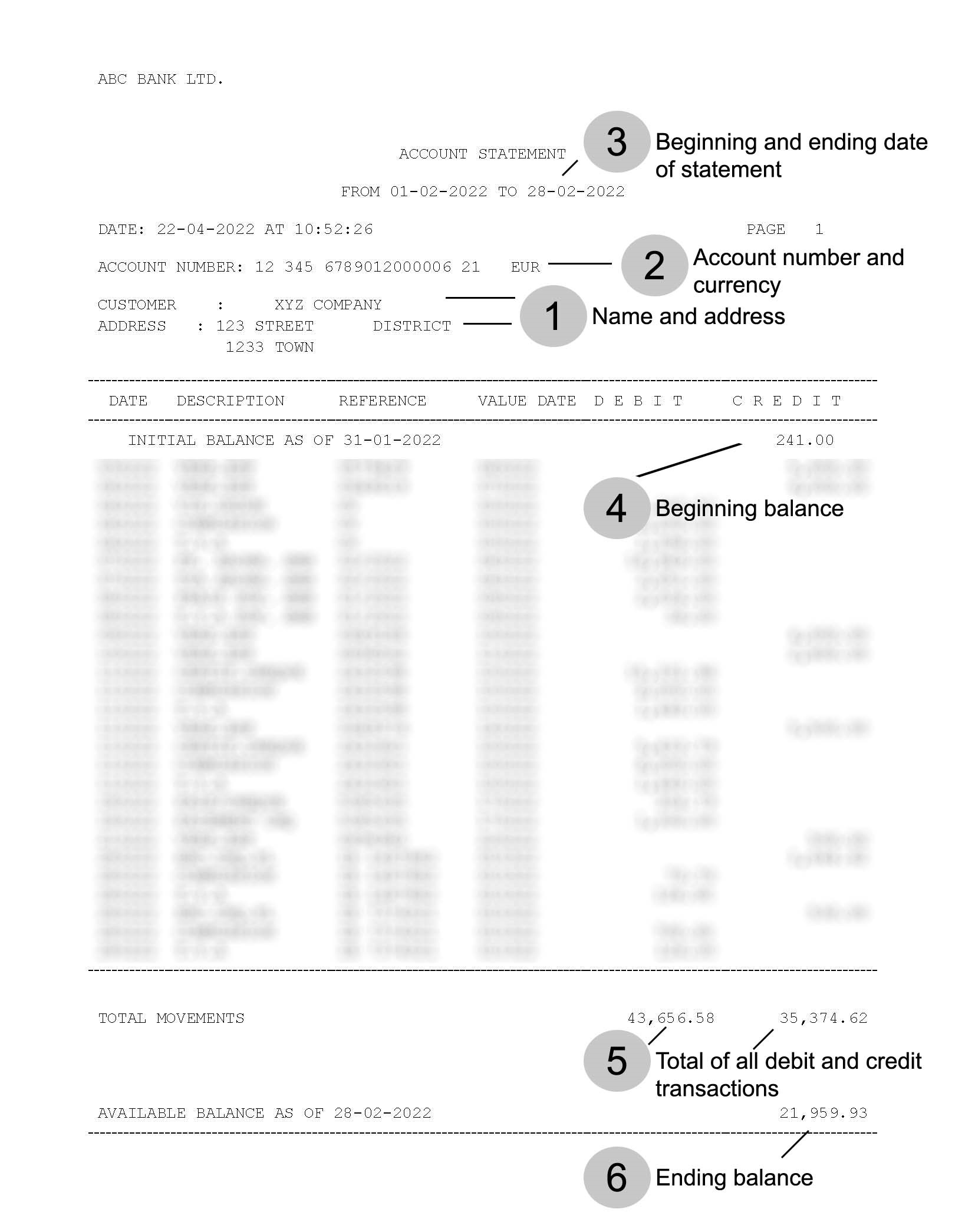

Statements from different banks may look different from one another. However, all statements contain the same kinds of information. Statements list the name on the account, the account number, the date of the statement, and the beginning and ending date for the statement.

What telephone bill would be accepted

Where the residential address is verified through reference to a utility bill, the subject person should ensure that such utility bill was issued in relation to services linked to that residential property. Therefore, a bill issued in relation to a fixed line telephone service installed on that property would be acceptable, but mobile telephony bills, which are not linked to a fixed premises, would not be acceptable.

WITHDRAWING MONEY FROM ATMS IN A FOREIGN COUNTRY

When you withdraw cash from an ATM in a foreign country, the operator of such ATM may charge a fee for cash withdrawals. The amount of such fee will be displayed on the ATM before you withdraw cash; by accepting to continue the transaction after such fee display, you enter into an agreement with the ATM operator on the amount of such fee. The fee will be debited from your bank account along with the amount of cash withdrawn.

Biometric Authentication

Biometric authentication is the identification of the cardholder by means of physical characteristics such as his or her fingerprint or face; it is used to identify the cardholder and to initiate a transaction. The biometric data of the cardholder for biometric authentication must be stored in the registered mobile phone of the cardholder if the cardholder wishes to use biometric authentication and his/her registered mobile phone is technically capable of facilitating biometric authentication.

Bank Costs

Different banks have different charges. Some charges a bank might require are listed below:

| Account opening fee | This is a payment that the bank deducts from your account for opening an account for you. |

| Service charge | This is a payment that the bank deducts from your account for taking care of your money and making transactions that you require. |

| Minimum balance | Some banks charge you according to how much money you keep in an account. For instance, the minimum balance for no service charge might be EUR 3,000.00. That means at least EUR 3,000.00 might be in your account at all times to keep from paying an extra fee. Different amounts might cause you to be charged larger or smaller fees. |

| Interest | Some banks pay interest, which is a fee paid for the use of your money. Usually you have to keep a certain minimum amount of money in your account in order to earn interest. |

| Transaction fee | Charge paid every time a payment is processed by the bank. This may apply to both: incoming and outgoing transactions. |

| Fee for holding funds | Charge paid for large deposits with the bank, i.e. 100,000 EUR held in current accounts, and more. |

| Fee for SWIFT messages | Charge paid when you request a SWIFT message (MT940 / MT942) in connection with your SWIFT payment. |

| Currency conversion fee | Charge paid for converting a transaction from one currency to another. |

| Card fees | Various charges in connection with the card issued by the bank. |

| Investigation fee on disputed transaction | Charge paid when you dispute anytransaction made from your account. |

The prices of individual bank products are influenced on the business activity of the customer and the projected turnover on the account.

Information on Application Forms

The information varies according to whether the applicant is a corporate body, a partnership or a sole trader and according to the requirements of each particular bank. These are, however, main details required on most application forms and supporting documents that may be requested:

| General Information | The name of the company; the address of the principal place of business; e-mail address; telephone number. |

| Legal Status and Tax Residence incorporation documents |

Date of incorporation and registered number; registered office address; trading name(s); licenses and registrations; VAT and TIN. |

| Business Information register of directors and shareholders |

Group structure and ownership information. |

| Details of All Directors and UBOs passport copies, utility bills |

Details of all directors and UBOs (address, nationality and date of birth, passport details, contact details, source of wealth (for UBOs) and tax residence. |

| Legal Information involvement in liquidations, bankrupcy or other legal actions |

Details of bankrupcy; proceedings against the company, its directors or UBOs; politically exposed persons. |

| Financial Information | Details of present and estimated turnover; incoming and outgoing transactions; countries involved in financial flows. |

| Declaration power of attorney, if applicable |

The application must be signed by an authorised signatory. |

Upon submission of the documents the bank will consider the application and may require the applicant to submit further information.

Depending on the business structure and requirements of the financial institution, the applicants may be asked to provide bank statements, business plan, copies of agreements and invoices.

The banks may also apply different fee categories to different applicants.